Many people are surprised when they learn how mortgage interest rates are determined.

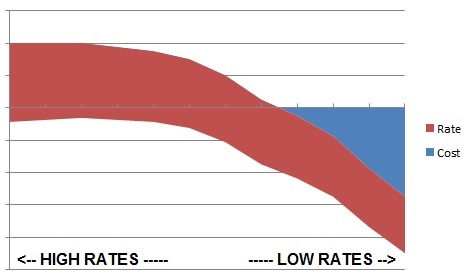

Most people understand the fundamental principle: the lowest interest rates cost more to obtain and the higher interest rates cost less. The graph above shows how you can obtain rates where there are “no real costs” (often absorbed by the lender offering the loan) compared with lower rates where closing costs must be paid by the borrower or an allowable 3rd party (such as the home seller).

Most people understand the fundamental principle: the lowest interest rates cost more to obtain and the higher interest rates cost less. The graph above shows how you can obtain rates where there are “no real costs” (often absorbed by the lender offering the loan) compared with lower rates where closing costs must be paid by the borrower or an allowable 3rd party (such as the home seller).

The interest rate offered is generally not determined solely by the bank or brokerage where you apply for your mortgage. Rather, banks and brokers attempt to “lock-in” your interest rate for a period of time long enough to close your transaction and at cost / fee and interest rate terms that have been disclosed to you in writing.

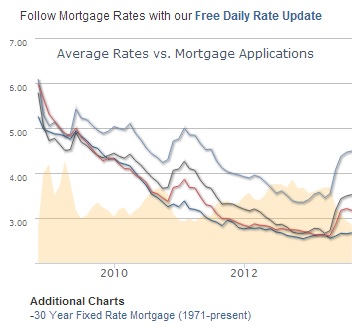

The following graph shows the range of interest rates offered from 2008 thru the later part of 2013.

Our free daily interest rates news can be sent to you by subscribing at: http://www.mortgagenewsdaily.com/mortgage_rates/#{uname=daveboye}

You can also bookmark this link to view interest rates news on your own at any time.

Interest rates are secured for bank and broker clients by obtaining the loan funds through 4 major categories of mortgage investment sources (most of these are publicly traded Mortgage Backed Securities- MBS):

- Conventional loans funded by the agencies of Fannie Mae or Freddie Mac (Financial trading instruments: FNMA and FHLMC)

- FHA, VA and USDA: Government funded loans (Financial trading instruments: GNMA)

- Jumbo mortgages: Can be called “portfolio mortgages” (Financial trading instruments that can be priced in part from major indices such as “LIBOR” )

- In-house mortgages: Offered by a local bank or credit union, based on their own cost of borrowing money

For FNMA, FHLMC and GNMA backed securities (the majority of all mortgages offered in the United States) the financial instruments are similar to the stock market, in that the cost for these investments is always changing and responding to all the other major financial markets. With these mortgage funds, the cost for the interest rate offered can vary constantly until you lock in your interest rate. Here is a look at a graph that represents a single day in the market for the FNMA 4.0% 30-yr security on 9/30/2013:

As you can see, the price of the mortgage backed security (MBS) is changing by the minute.

(Note: in-house and portfolio lending interest rates will tend to change less often, but they are always subject to change at any moment as major indices move)

When you apply for a mortgage, the banks and brokers offering loans will usually try to issue pricing for various interest rates that change as little as once per day and on a volatile day in the market, could change as many as 3 times in one day. This can happen until your interest rate is “locked in.”

From the MBS illustration above, investor’s are trading the FNMA 4.0% 30-yr security on 9/30 with 480 BPS (basis points) spread between the literal cost of the security and the actual value. This means that “behind the scenes” there is 4.8% of the value of the MBS (mortgage backed security) being handled to make the investment of a 4.0% security available for mortgages. Therefore, on a $100,000 investment or mortgage there is $4800 in funds being “traded behind the scenes.”

Interestingly, the interest rate offered by most investors on 9/30/13 was higher than the 4.0% MBS security instrument. In real dollars and interest rates, one of our mortgage investors would offer a mortgage interest rate based on this instrument and other instruments at a range of interest rates and costs after the investors accommodate their own internal costs. They will likely use a combination of 4.5 MBS and 4.0 MBS and some other instruments to provide their offered interest rate for that day.

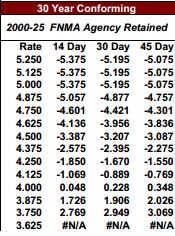

The national average 30-year interest rate on 9/30/13 was 4.28%, and one investor’s price sheet showed that if a borrower obtained a locked-in interest rate at 4.25%, for 30 days, they would be able to use about 1.670% of the mortgage value to help pay the settlement costs of the loan (such as paying the mortgage broker, title insurance, closing fees, appraisal fees, hazard insurance premiums, taxes and/or other fees) for selecting a 4.25% interest rate. (On a $100,000 loan, this would be $1,670 in rebate to the borrower to help pay their settlement costs)

(see the interest rates and “cost of the rates as a % of the loan amount” in the chart below), So as you can see, there is a cost v. interest rate relationship for each 0.125% of interest rate offered at any given moment with each mortgage investor. At Black Diamond Mortgage Corporation, we present our borrowers with our actual investor rate sheets, along with any “adjustments being assessed” for credit scores, loan sizes or other risk variables. Then we let our borrowers decide what they would like their interest rate to be based on this information, including an analysis of the lowest interest rate offered compared with the lowest cost mortgage offered (after considering the maximum rebate available).

So as you can see, there is a cost v. interest rate relationship for each 0.125% of interest rate offered at any given moment with each mortgage investor. At Black Diamond Mortgage Corporation, we present our borrowers with our actual investor rate sheets, along with any “adjustments being assessed” for credit scores, loan sizes or other risk variables. Then we let our borrowers decide what they would like their interest rate to be based on this information, including an analysis of the lowest interest rate offered compared with the lowest cost mortgage offered (after considering the maximum rebate available).

If you are wondering about “adjustments being assessed”- essentially, interest rates are better for great credit scores and homes with equity. When a loan is not within the ideal parameters for the investor, they may still offer a loan but they may apply “cost adjustments” to deal with their perceived added risk for offering a “less than ideal loan.”

It is important to note that retail mortgage banks and traditional banks will often not disclose how much they earn after the sale from the mortgage offered, but if you examine the amount of “behind the scenes money” being traded on the 4.0FNMA security on 9/30/13, there is a lot of money being traded “behind the scenes” when the national average interest rate is 4.28%. While at Black Diamond Mortgage Corporation, we cannot control the amounts being traded “behind the scenes” on mortgages, we will always show our borrower how much is being retained by our firm in the form of lender paid or borrower paid compensation.

Most importantly, you simply need to ask for written disclosures from your bank or broker to know what the costs and the interest rate will actually be for your loan, and that is a great time to confirm the “lock terms” so that you know your disclosures will not significantly change in the future. Most banks will require a loan application for a “bona-fide” proposal, because their interest rates and costs / fees are based on the specific details of the borrower’s loan application.

Rates offered without a loan application are like asking a question, “how much does it cost to build a bridge?” It depends on the many variables that go along with building each unique bridge 🙂

I imagine if you read this far, you have more questions than answers. Please contact us directly to answer all your questions, or if you want to see the terms you would receive, just apply for a loan today on our website.