Materials PDF: Why is a VA Loan is Better than Cash

Why is a VA Loan is Better than Cash

- 100% of Appraisal Value

- Tidewater Option

- Highest available DTI (Debt to Income)

- Best % of on target appraisal compared to other programs

- Stronger desire to close

- Rewarding someone who has served our country and earned a benefit

The most common myths regarding VA loans include:

- VA loans are denied at a higher rate (risk).

- VA loans are expensive for Veterans.

- People with weak financial backgrounds use VA loans and other “no down payment” mortgages to buy homes.

- FHA or Conventional loans are better for Veterans than VA loans.

- VA loan appraisals are slow to process and usually come back with low values.

- Sellers have to pay all closing costs.

- VA loans can only be used once.

VA loans are denied at a higher rate. False!

According to anecdotes from many sources, VA loans are harder to process.

The Lowest Denial Rate

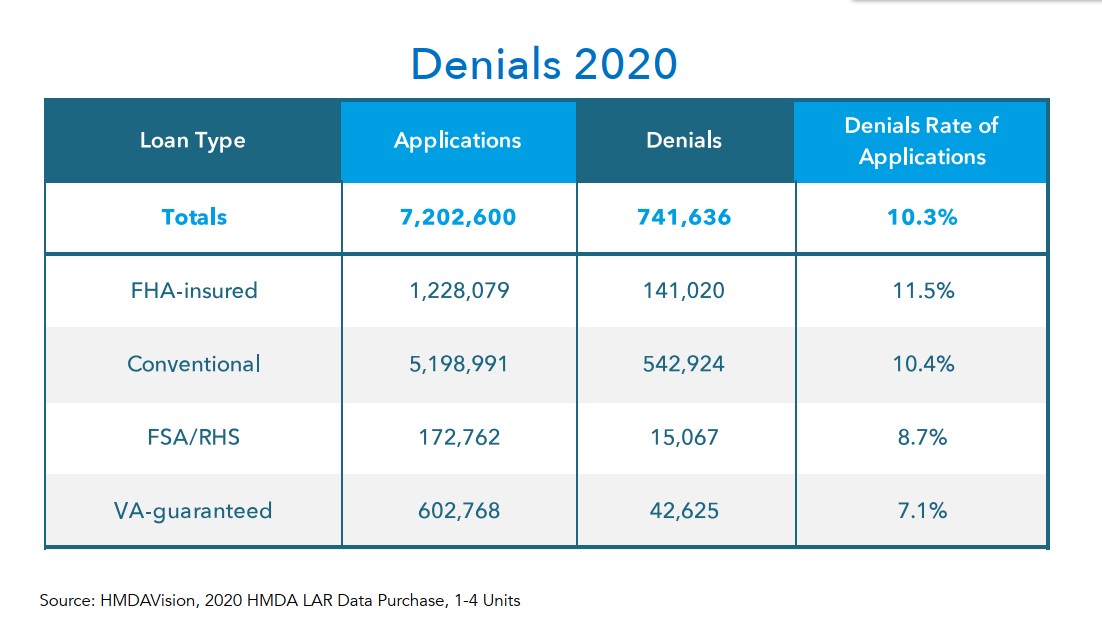

We used Polygon Research’s HMDAVision1 to comb through the 2020 HMDA LAR data to gather granular insights into loan pull-through, the loan life cycle of every loan, and lender by country, state, county, and census tract, as well as borrower demographics and loan attributes.

As shown in the table below, VA loan applications are denied by lenders 7.1% of the time, which is the lowest denial rate among all loan types.

FHA or Conventional loans are better for Veterans than VA loans. False!

This depends on each individual Veteran’s situation, and we will try to address it as objectively as

possible.

Top Benefits of VA Loans

To answer why borrowers choose VA loans, let’s look at the most recent Survey of Consumer Financ-

- Scoping the survey responses to those where either the respondent or his or her spouse had

military service, Veterans’ predominant reasons given for choosing VA loans were:

- Interest rate

- Special features for first-time homebuyers

- Amount of the down payment

Veterans are provided with a lower interest rate through the VA IRRRL program. VA IRRRL recipients

also have the ability to skip the appraisal and proof of employment processes in most cases, do not

need to verify debt-to-income or have a minimum FICO score check, can change loan terms, defer

mortgage payments for two months, and can possibly get a faster closing.

In Conclusion:

Veterans, their families, and professionals benefit from a thorough understanding of the VA loan product. In this white paper, professionals in the industry examined seven myths associated with VA home loans:

- VA loans are denied at a higher rate. False! VA loans have the lowest denial rate among all products.

- VA loans are expensive for Veterans. False! VA loans have the lowest origination fees, the lowest interest rate, and the lowest rate spread.

- People with weak financial backgrounds use VA loans and other “no down payment” mortgages to buy homes. False! In our study, Veteran homeowners have an 18x higher net worth than home renters.

- FHA or Conventional loans are better for Veterans than VA loans. False! Veterans have the option of a low interest rate, availability of special features for first-time homebuyers, closing costs are strictly regulated by the VA, and no down payment through the VA loan program.

- VA loan appraisals are slow to process and usually come back with low values. False! On average, VA loan appraisals take seven to ten days to complete, which is typical of both Conventional and FHA loans.

- Sellers have to pay all closing costs. False! Fees for origination, appraisal, title, discount points, credit reports, and well and septic inspections must be paid at closing. The only costs the Veteran cannot pay are the Wood Destroying Insect Report (WDIR) fees, but anyone may be able to cover them.

- VA loans can only be used once. False! VA loans must abide by underwriting guidelines but subsequent and repeated use is allowed.

For more information, please contact us at Black Diamond Mortgage – 406.862.4999

David Boye

david@blackdiamondmortgage.com

NMLS #235086

Black Diamond Mortgage

106 2nd Street E.

Whitefish, MT 59937