See attached PDF for Outline – Build Your Real Estate Empire and additional Flyer for Home Loan Scenarios that are referenced in this video.

Build an Accelerated Real Estate Portfolio

It is possible to build a Real Estate Portfolio with well over $1 million in value and multiple homes with as little as $50,000 initially invested, a traditional mortgage payment for 1 home, in as little as 3 years

Personal Real Estate Testimonies

- Dave – Mortgage Broker/Owner at Black Diamond Mortgage – Shares his experience.

- Curtis – Real Estate Agent with ENGEL & VÖLKERS – Shares his experience.

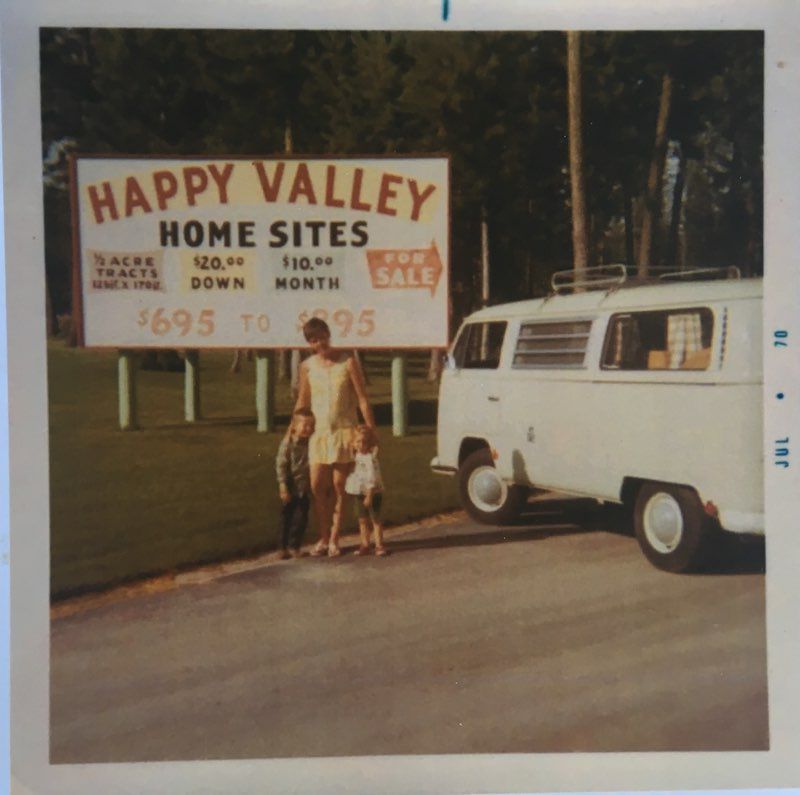

Highlight photo from Happy Valley Home sites – What does this photo tell you? Life in the 70’s perspective looking back.

Major Point 1- Have a strategy!

- Buy with the long-range goal in mind- Curtis, talk about considering deferring your dream home opportunity till after a portfolio is achieved

- Curtis, what makes a good Cash flow home?

- The mortgage strategy

- Example 3 home scenario (see attached PDF examples of Home Loan Scenarios here)

- Understanding the maximization of programs created to help you acquire real estate with little money down: Rent can cover the mortgage on all home replacements, if strategically managed **** Unlimited property purchases at 20-25% down, and rental income covers the mortgage Occupancy Requirements: General rule: Meet the loan commitment occupancy requirement within 60 days – Maintain a primary residence for 1 year (Generally a fraud alert on initial loan documents, not necessarily a requirement- changes in circumstances can expedite)

Major Point 2- Things to watch out for

- Curtis- Location, home type, contract strategy

- Dave- Credit (3 C’s) reserves

Fulfilling the dream

- Never take no for an answer, it’s only when and how!

- Curtis- tips for success (attitude, emotional strategy)

______________________________________________

February Class – Building Real Estate Wealth – Transcript

David Boye: [00:00:05] All right, welcome everybody. This is our second class in our series, we’re going to be doing all year and we’re bringing value to the community of people interested in real estate. And our last class was on self-employed borrowers, and this week we’re going to be talking about how to build a real estate portfolio quickly using the tools that are available to you in real estate finance and also just using good strategy and skills. So in our presentation, we’re going to be highlighting basically just an easy template to acquire, you know, well over a million dollars in real estate, three properties and as little as $50000 investment to start off your real estate portfolio. And let’s talk about general principles of acquiring wealth of real estate. And I didn’t want to do that alone as a mortgage broker, so I brought in an expert in real estate. Curtis, great to have you. I will take that. And so to get started, just a couple of things. If you don’t have the materials that we’re sending out, we will get them to you. So we’ll need your email address. And so either during this presentation or afterward, you can message Black Diamond Mortgage and let us know your email address.

David Boye: [00:01:30] And we’ve got a outline of what we talk about and we’ve got a real estate scenario that’s actually a real real estate scenario in the flathead market, just to give you a vision of how this could be done and a few other things. And so we want you to get those materials, so definitely reach out with your email address and get that. And next month, we’ll be doing another one and we are still deciding the topic. But next month will either be construction so that people wanting to get construction going in the year 2022 will get the tool the toolkit for getting construction financing put together. And we’re also considering doing we’ve always done, fix your credit, February in the past. And so anybody that feels credit challenged and wants to get into real estate, the playbook for how to get your credit, where it needs to be by real estate. But with that, I think I’ll start with you, Curtis. If you just want to introduce yourself and tell us about your career in real estate and also your own personal buying real estate real quickly just where it can get to know you.

Curtis Wagner: [00:02:39] Sure thing. Well, thanks for having me, first of all. So Curtis Wagner, I’m a real estate advisor here at this office, actually at the Kalispell, England Volker’s Western Frontier office. I’ve been in real estate for just over five years now. I closed. I averaged around 30 to 35 transactions, representing both sellers and buyers, kind of an equal split. And this last 2021 finished out the year at over $13 million in sales. Personal transactions I have purchased four homes and each time it’s kind of followed the same typical steps that real estate brings into. You know, you start with a smaller home as your first introductory home, first time homebuyer, you know, kind of just capitalized on the equity and and the two year process stayed in that one for two years. So that one with the profit dump that went into another one and moved up step by step. And so now I’m on my fourth one and and kind of got situated with the home size that we want, and it’s been a great process, just capitalizing on the investment. You know, you’re investing in yourself.

David Boye: [00:03:45] Well, great. That’s a good strategy. So that’s in addition to what we’re talking about today. What Curtis has done is basically about tax advantage that two year window, right? Yep. And then what we’re slightly honed in on today is least amount of cash required to acquire lots of real estate. And all of it works as long as you have a strategy. Myself, I own Black Diamond Mortgage with Maria Phelps, and I’ve been in the mortgage business for 15 years and have seen multiple market cycles. And my own personal first real estate investment was I got married in nineteen ninety six and my wife and I moved to Montana. And part of that move was real estate price driven. We were in Colorado and things were way more expensive in Colorado. And at that time, it sounds crazy to talk about it right now, but coming to Montana was a low cost way to enter real estate, so we thought we could afford to make a life here. So we bought a house and white fish. It was a two bed, one bath house. It was seventy seven thousand dollars and at the time I was working at a tire shop and my wife was working at the sports and ski house and we were able to do that. And I remember specifically, though, that. That price we paid the locals who lived in the market were telling us that we were overpaying at seventy seven thousand and that just a year earlier, that same house might have been 50000.

David Boye: [00:05:17] And we had to go through this tension about, you know, should we buy a house right now knowing that the price is much higher than what other people who had been living in that market had experienced in the past? And so looking back, it’s like, Oh, that was a great decision. But when we were experiencing it, it was emotionally challenging to pay top price for a home, you know? And so I also included in the email out really great photographs. If you can’t see it right now, just I’m going to just describe it to you. You can visualize it. But there’s a realtor up in Whitefish Dodd, his his name and he he is in the photo in the 70s with his dad, I think. But he’s standing in front of a sign at Happy Valley and it says you can buy a lot in Happy Valley home sites for six or six hundred dollars and you can get into it monthly for $10 a month. And there’s a family and they’re standing there. And so you look at it now and you think, my gosh, that’s so cheap. Like, lucky them.

Curtis Wagner: [00:06:20] Yeah, I take a lot for six hundred bucks.

David Boye: [00:06:22] Yeah, but I was actually alive then, and I remember that wasn’t like, that was hard. Yeah. So to scrounge up the money was hard back then. And everything I remember in early 80s in my family, like one year we got a VCR and it was $800 and we all didn’t get gifts that year, so we could get a VCR because that was the big thing at the time.

Curtis Wagner: [00:06:50] You know what? Yeah, it is this big.

David Boye: [00:06:53] It’s just tape and you put it into the net to show that to me with it. Yeah. It doesn’t mean anything now. That’s crazy technology. But at the time, you could watch a movie in your house. And but at the point being, the sacrifice required with money was hard. And so here we are in this current market. It seems a little overwhelming, which is why I want to do the class. Yep. And so big, major point number one that we want to get to you today is to have a strategy if you’d like to acquire a lot of real estate. And so we’re going to run through kind of. But to give you like an easy principle, the lending environment is such that the government and a lot of programs incentivize getting your first house. If you want to acquire a lot of real estate, you really need to look at that piece. When thinking about how can I acquire a lot of real estate because they’re providing you a lot of assistance? And so one of the things is very little down payment required to buy a primary residence. And so the easy playbook is essentially that you can acquire a whole bunch of real estate if done strategically with very little down to get your foot in the door under the real estate market. And I just think a lot of people their first move to get real estate is more driven by we need to buy a house now because we got married or we just have kids, which is great. But then the strategy is different.

Curtis Wagner: [00:08:23] It is. It’s a hundred percent different.

David Boye: [00:08:26] So with the long range goal in mind, you can do both. And so this is just an example. And then if anybody has any questions, reach out any time during this and we will address your questions. But Curtis, why don’t you talk about a little bit about what you’ve experienced dealing with clients or just your own opinions as it comes to the strategy of deferring your dream house for the opportunity to acquire some real estate first and then maybe get your dream house down the line?

Curtis Wagner: [00:08:56] Yeah, like I said, it’s it’s a strategy. It’s it’s a completely different mindset. And the first thing I’d like to say is it’s it’s not a sprint, you know, it is a long term goal. Some of the things that that I’ve ran into and when people are considering, Hey, this is the type of house that we really have dreamt of wanting, this is our dream house to get people to come in and they want the moon and it’s their first house. But in this strategy here, you don’t have to think of it as your dream house. That’s your ultimate goal. That’s your end goal. So in order to get there, if you’re looking for, you know why you would defer to your dream home and start out acquiring these properties. If you’re looking for acquiring a rental property, you might think about your dream home might be in the rural area, might be out in the woods, might be a long ways away from home because you don’t like the hustle and bustle of the city life, but it’s going to be harder to find renters that want to go that far out. There may be one or two that do like that, but the majority of them are going to want the convenience of of the amenities in town.

Curtis Wagner: [00:10:00] Another one is is size. You know, your dream home. It’s. Generally not going to be a 900 square foot house with two bedrooms. So you want this 4000 square foot home, you want two or three living areas. The more the larger square feet, the more bedrooms, more maintenance, more upkeep, higher taxes on it. Your rent has to be a lot higher as well. So keeping in mind that your size of a home, your dream home is going to be a lot larger, most likely than acquiring some of these properties. Lastly, is we all have a unique style. You know, your style might be very, very modern or it might be rustic. There’s there’s a lot that you might like in a home that’s to your style, but it doesn’t appeal to the masses. So think about that when you’re acquiring these homes, it does not have to be the rustic log cabin of your dreams. It just has to be a good functional quality built home.

David Boye: [00:10:53] That’s great advice. So essentially, you need something that’s going to last and produce cash flow. And then and then you’re looking down the road for the dream home. Well, yeah,

Curtis Wagner: [00:11:05] I mean, I use the example of, you know, a dream home. Some people like to have this master bedroom that is on the top floor overlooks the lake. A lot of renters, they don’t want the master bedroom climate upstairs. So what’s unique to you is to you. But when you’re doing this strategy, look to the masses, look at what’s going to appeal to most people.

David Boye: [00:11:25] Good and so in cash flow homes. I don’t know what you’ve seen, but what makes I think you addressed a few pieces, but when you want to get a home that’s good at cash flow, what are the things you’re trying to help people see out there?

Curtis Wagner: [00:11:41] Well, I’ll start with the first point. I, when talking about a cash flow home is I like to go off the one percent rule. One percent rule. Rule of thumb is that your rental rate should be at least one percent of your purchase price, so your gross rental rate would be divided by your what you bought the home for. But just because it meets that one percent, or maybe it’s just below that one percent? Oh no, I can’t. I can’t go purchase this. It’s a bad choice because it doesn’t meet the one percent rule. It doesn’t necessarily mean that it’s a bad choice, or it doesn’t necessarily mean it’s a it’s a perfect choice if it is just at one or above one. There’s a lot of different factors in there that come into a cash flow home, and that’s really going to be your income and expenses. Ok, so you have your income from your rent and then you have expenses. That’s one large thing you have to think about just because it might rent out for a good price. There are different expenses to each home based on where it’s located neighborhoods. So things that you talk about expenses, operating expenses, you have your mortgage, you have taxes, you have insurance and then you have your I like to call it, like vacancy fund to where what happens on the weeks that or months that it’s not rented and then you have your maintenance fund. So what about that, you know, the HVAC system that you need the service every single year? What happens if the water heater goes out so you have to have a reserve fund? You also have a lot of times as you acquire more properties, you have a property management company. So you have to take all those in considerations. So you take your gross income, you minus those expenses, plus your reserve funds and that’s your cash flow.

David Boye: [00:13:24] So basically, I

Curtis Wagner: [00:13:26] Think minus expenses and minus your you can you can group in your reserve fund as an expense. But a lot of people, I like to separate that because they don’t think of that as an expense. But that’s one of the biggest ones because if you have a water heater that goes out or you have a, you know, a roof, for some reason that needs to get replaced down the road. Those are huge expenses and there’s we could go into the numbers, but I don’t think this class kind of is is going diving huge into the numbers, but you’ve got to equate for, you know, 10 percent on a on a maintenance fund, property management companies that are anywhere from nine to 12 percent.

David Boye: [00:14:01] An easy way to do this is if you grab just a regular old personal tax return. There’s a form on there called Schedule E, and that’s how we look at the cash flow of property, but basically breaks down the typical costs of homeownership. And you have to report it to the IRS in order to write off the expenses. But a good strategy would just be to put your income at the top, chunk them out underneath and see if you got a net net income at the bottom. You know, there was one other question Oh yeah, I was just

Curtis Wagner: [00:14:28] Going to say like, you know, finding the one percent rule nowadays, as you are well aware, it’s impossible to meet unless you’re buying. Multifamily is like single families are going for upwards of 300. It’s nowhere near even close to the one percent rule. Like I’m saying, what are you guys finding as far as like, I know it’s a rule of thumb. So yeah, everything I’m buying is not one percent rule.

David Boye: [00:14:52] So the question is just so we can get on the microphone is the one percent rule and and it’s hard to do in the market right now. What are we doing about that? What are we seeing so?

Curtis Wagner: [00:15:03] Yeah, you know, like you said, it is a rule of thumb. And so it’s really about what works for you. You know, if you can get a property where you can get it rented at least after living in it for a year, after living in it for two years, and you can get someone that comes in and and gets close to what you’re paying for your mortgage, you know, even if it’s 75 percent. David, we’ll talk about that later. But if you can get that close, then you can move on to the next property count that as income, you know, and then you can move on to your next property. So the margins do get a little tighter. Some of these margins before or you were see a huge profit on just one. I think now, you know, this whole strategy is acquiring multiple ones so that you can, you know, make a decent income off it and get your dream property. Short term rentals? Yeah, it’s that short term rentals are. That’s going to be your biggest, quickest bang for your buck over here. There’s a lot of restrictions on it, though, so finding that exact property and then the price points on those properties can be pretty steep as well because they can be rented out nicely.

David Boye: [00:16:06] So when it comes to short term rentals, they’re more profitable. They’re a little harder for gaining qualification for mortgages. So once you get them, that’s a great option if they’re able to be rented. When you’re trying to buy them and acquire them, you’re going to have more success convincing lenders to like what you’re doing. If you’re doing it quickly without the history of success, by being getting ones that can cash flow on a monthly basis. And so the scenario we’ve outlined today is kind of uses the monthly as the guide. But once you get the properties, it’s true statement that you’re going to make more finding those other opportunities for rent. I think I’ll hop into that now. So if you have the email, you’ve got this three page scenario that I drew up, and if you don’t, I’ll just talk you through it real quick. I’m not going to go line by line through the scenario, but I just want to give you a vision for using the lending tools that exist for young families to gain real estate portfolio. So the easiest thing to understand is they’re not requiring a lot down. And then once you acquire one property, you can then convert that to a rental to go acquire your next property. And that leverage and movement is what gets you the quick access to lots of real estate. And so in in the U.S., with the way lending is right now, just the easy principle is once once you say you’re going to buy something as your primary residence, you’re basically saying that’s what’s going to be the case for the next year.

David Boye: [00:17:46] At the end of the year, you’re up for doing it again. And there’s the big opportunity because every time you buy a primary residence, you don’t have to put very much down. And so if you’re willing to move and you want to start instead of going to the dream house first, if you want to go at the real estate portfolio first, the first thing you’ve got to get in your head is how many times can I use the primary residence benefit to maximize my situation? And you know, in general, you can use it several times over time. There will become a moment where a lender is going to look at you and say, Wait a second know, but you can get three really quick and you look completely fine and you’re not doing anything wrong. So it’s available to you. So house number one zero to three percent down. So find yourself a house. Any house? And so I pulled up one on. I just went on to Curtis’s real estate search engine and I did this on Sunday and I pulled up a house and there was a cute little house in downtown. I don’t know much about the details other than the fact that it was in that amazing price point of like $300000. So I was like, Ooh! And so what was my driver there? Well, one of the one of you asked the question like, Hey, how do I get into this? None of these numbers pencil out.

David Boye: [00:19:09] Get something, something that you can buy. So there’s one out there. It exists. It’s on the market. It’s in that price range. It’s a probably a dumpy little old house, but it’s a house. It’s got bones, you know, and it’s in Kalispell and you can rent it later. So I did the numbers and a person could qualify for this house. The mortgage payment with everything in it using only three percent down, is sixteen hundred and fifty seven dollars a month. Ok, so you’re buying a $300000 house. If you do three percent, you’re investing nine thousand to get your first house, OK? You could potentially buy your first house with the zero down options. I do want to throw into the mix, though, that if you’re thinking of a long term rent strategy, the zero downs, a lot of them have rental restriction. And when you take that financing, so if your next move is going to be to rent, check with whoever you’re getting the mortgage through and make sure that that zero down is worth it to you. If your real goal is to have it for one year and then flip it to a rental, you might be in the wrong financing product if you got like a down payment assistance option or one of these things. And so there’s a program out there. Fannie Mae Freddie Mac three percent down. And you can convert it to a rental and there’s no no harm, no foul after one year of ownership, and you can do five percent down and do the same thing.

David Boye: [00:20:33] That’s a great product. Every time I say down payment in this presentation, just know it’s gifted is is OK. So if you have family that want to help you do this, that is OK. So you don’t. You know, the grand total of everything we’re going to talk about is is getting well over a million dollars in real estate, think like a million three and you put $50000 on the table and you need to be able to make a mortgage payment one mortgage payment. And that’s a secret sauce. So you buy a house, no. One, you need a minimum income of fifty four thousand a year. That’s reasonable if you are a couple or an individual in today’s world of having a job, that’s that’s not a crazy income. It’s not a super high income. You can enter the game with very little money and a fifty four dollars, and you can buy that house that I outlined there. So then you get your first house, you move in and then you start planning, and maybe a few months into it, you start talking to Curtis again. You say, Hey, let’s start getting ready. When I hit my one year anniversary, I want to do it again, you know? So if you flip it over to the next one, I found in Kalispell two houses on one line, which is a two unit property, and this is important and one of the members of our audience asked about this question.

David Boye: [00:21:57] But some way, if you’re going to try to acquire multiple properties and you want to do it easily and quickly, try to find a multi-unit that you can afford. And the reason is on a multi-unit, the rentals of the other units if you live in one count towards your qualifying income. So if you buy a two unit price and in the current market one, the prices are up, but rents are up, which really helps you because if you can rent a unit, the appraiser can go out and confirm for the lender that you can rent that other unit for quite a bit of money, you know, which means you can put that money on your loan application to qualify for more house, but either House number one or house number two. It’s great if you can get multi-unit because the other units help you qualify to own this property. So in this scenario that we outline, once you buy the second property after year number one, you’re actually getting ahead on your income, your qualifying income, because now you’re going to rent house number one and then you’re going to buy a two unit property and rent the other unit. And so now you’ve got two rentals going and you only own two properties and now your rental income starting to push slightly above where you were before, which is going to help you in another year when you go for house number three. So at some point, look for the multi-unit.

David Boye: [00:23:23] A couple of details I want to point out about multi units. Fha is kind of the best multi-unit product out there, and basically it’s three and a half percent down. A one unit loan is in like the four hundred thousands and then as you go into multi units, they raise the loan limit so you can get a pretty decent property with either two, three or four units and use the rental of the other units to qualify you to make this purchase and you’re still only putting three and a half percent down. And the government’s totally good with this product because they’re actually interested in helping people acquire real estate. And so back when they created FHA, one of the ideas was to move people out of poverty through homeownership. And so they actually like people buying a multi-unit rental and helping. And the idea is, if you get a piece of real estate and you become successful, you’ll move out of a lower income environment. And so the this is a desirable situation. And then at that point on the scenario that I drew up, you’re renting the other units and you don’t have any more income from your job and you now have two properties and your cash flowing and your actual cash out of pocket investment up until property number two is twenty five thousand dollars. And so now you’re owning seven hundred and sixty thousand other real estate because you’ve got two homes and your cash flowing on your job. Regular old job

Curtis Wagner: [00:24:56] And you’ve moved out of the first

David Boye: [00:24:57] House. You’ve moved out of the first second house. Yeah, good point. So you have to you. So the primary residence piece is needs to be validated by a lender, a couple of details getting into the weeds, but good stuff to think about is occupancy must be for the year that you’re taking the loan and you have 60 days to take occupancy and still be legitimate so you can buy one that’s rented and not be able to get into it for two months. And that’s still OK to buy as your primary residence. And there’s other details like that that are worth looking at. So when you’re buying multiple properties and you’re moving, yes, this can be a primary residence. Usually it’s dictated by, you know, like as you get farther into it and you know, they look at things like, where do you get your bills mailed your tax return? So you need to you need to live in the place, you know, and they do. They do want to know that you’re living in it. But one year is the standard, and after a year you’re kind of cleansed of the responsibility to stay that way so you can move on to the next one. That’s where the real opportunity is, is just doing it for the amount of time that they require and then doing it again.

David Boye: [00:26:11] And so then maybe on home number three, you do move into your dream home. So in the scenario I outlined, I went ahead and assume that by the time you get to year three, maybe you are making just a little bit more money and maybe you’re buying one that isn’t as likely to be a rental because you now you’ve got two rental properties and you’re moving into home number three and now you’re going to settle down because now you’ve got one million two hundred and sixty thousand dollars worth of real estate and you got mortgage debt almost that high. Maybe you need to take a break and kind of let the market help you. You know, so if you’d have done this scenario a couple of years ago, the market would have given you a big gift because while you took on the debt, then the market went up. And so now you’re actually in and you’ve got a mortgage that’s less than what you actually own just because the market went up. And so that’s the huge opportunity. Absolutely. The beauty of real estate.

Curtis Wagner: [00:27:07] Yeah, at that point,

[00:27:10] Some of that equity from the.David Boye: [00:27:13] Purchase before that leisure strategy, so I’ll get a question about using the equity from the homes and yes, so once you get the homes and you, you gain equity. One of the cool tools that you can use is that equity can then become a way to get down payment money for future purchases, such as using a home equity line of credit. You can do cash out refinance loans. So. So my my idea is big picture here, and maybe you can jump in on this through your own experience. But so the playbook is use the primary residence tools as far as you can use them and handle them to gain a portfolio and then settle in and then and then start, you know, pay your mortgage hanging there for a while. The market using those examples I brought at the beginning of the class time is going to take care of things. If you can afford the payments, you know. So maybe, maybe it takes 10 years to get the big jump in real estate. But eventually it’s going to happen because history is a guide. We can look back in history and see that everybody wants to own real estate. Eventually, the prices go up. And now the beauty is once you’ve secured your real estate, your acquisition cost has been capped and your principal and interest has been capped so everything can keep going up from there. But yours doesn’t. So if the market goes up from there, one of the benefits is you can use that equity. And so now maybe you don’t need to use low down payment products in the future because you have equity. You know, the equity will give you the ability to pull cash out and buy more property, if that’s if that’s a goal.

Curtis Wagner: [00:28:50] So, yeah, I like what you said there. It doesn’t go up, your payments don’t go up, you know, it’s capped. So people are kind of weary of even this market of getting in. Well, I’m going to wait it out. Who knows? You know, a year from now, we could still be escalating. And what you could afford 12 months ago, now you can’t afford. So things change. So jumping in and taking that, I wouldn’t call it a risk. It’s real estate, but good things come from taking some risks. But I like what you said there, that it caps out

David Boye: [00:29:20] And just do what you can afford. So Black Diamond Mortgage, we’ve had clients coming in and maybe the exact thing they wanted to do this year is out of their price range in Montana as a state. There is stuff in your price range, and that’s probably one of the things I would like to emphasize the most is if you are just like focused, hyper focused on the town of whitefish and you’re like, I can’t get into whitefish, but you’re right, you might not be able to get in whitefish right now. But if you start building wealth through real estate down the road, you might get the tools to get in the whitefish if that’s a goal of yours. And, you know, examples would be like communities that are maybe an hour out from here are much less priced than this community. And so what are you trying to do to try and build real estate empire to try and take advantage of real estate values going up? Well, they’re going up nationwide. So if there’s one you can afford in another market, use that one to get you started because if you don’t start, the whole system might just keep moving along and you’re getting left behind. And that’s a bummer because I’ve had a lot of clients in my office recently that were in 2019 thinking they were going to wait for it to cool off. You know, now what’s cooling off look like, maybe it’ll get back to 2019, you know, but they’ve had they pulled the trigger, they would have been better off and we didn’t know.

David Boye: [00:30:38] I didn’t know when they were asking me these questions, you know, want to hit a couple of other things while we’re on this and everything I was just talking about is buying primary residences over and over again because the huge benefit is the least amount of down payment required. Ok, so that’s the carrot on doing it that way. If you have like twenty five percent to put down on a property, here’s another beautiful thing in lending. In that scenario, you can buy as many homes as you want and cash flow the homes just over and over again without limit for the most part. So just use easy math like you buy a million dollar piece of real estate and you put two hundred and fifty thousand down and it has rental potential. Then the rental income from that property can immediately be on your application to help you. So, so the twenty five percent and sometimes it’s 20 percent. But if you have that down payment, then then basically you can just bought. You don’t have to season it a year. You don’t have to like. There’s lenders out there that that are happy with that equity position. And so if you want to buy a lot of rentals or another scenario might be like, I’m carved out in my income, I can’t afford any more property.

David Boye: [00:31:57] If you have that down payment, that’s not true. You can literally buy as many as you want with that amount of down payment. So common misconception is I don’t have rental experience or I. I only make $100000 a year, so I can’t afford property No. Two. Outside of that scenario, I just outlined buying primary residences and moving them every year to rentals. If you just want to buy rentals, the twenty to twenty five percent down scenario is going to be limitless. So if you don’t want to do it the way we talked about where you buy primary residences and then move out and buy another one, if you can save up 20 to 25 percent down, you can just buy and buy them, buy them. You don’t have to come up with all cash or 100 percent. Know so. Building a real estate empire with that down payment is the rental income. The lenders are going to give you credit for it right away. And some people think you need two years experience and things like that, and the current lending environment is they’ll they’ll give you the the rent, the market, rent right away. So that’s a great opportunity for people to have a little bit of money. So I’ve got a question from the back go ahead with that option of putting

Curtis Wagner: [00:33:11] 20 or more percent down. What’s the personal income limit on that? What how much income this individual have to have in order to be able to just buy a property

David Boye: [00:33:19] For rental income? That’s awesome. So Kaley just asked me if you don’t even let’s just pretend like you don’t have very much income. So let’s I’ll just make a scenario up here. But let’s just say you you you have a $500 a rental and some room of a friend, and you, you make $1500 a month. And that’s it. There’s no other debt, but that’s you just don’t have a lot of income, but you have a twenty five percent down payment. You want to buy a rental. The cool thing is, there’s lending products in the market right now that are like, Go do it. So what do we need to get the deal done? The primary thing is just some basis of rent, so we’ll have to get like an appraiser or a third party like landlord company or somebody who’s going to step in and say this will rent for X and as long as it clears the mortgage you’re in. Great question. In fact, that’s super motivational if you don’t want to do. If you don’t want to have enough income to qualify to buy your own primary residence and do this multi step process, the other way is down payments.

Curtis Wagner: [00:34:27] So you get a question as well. Yeah, sort of answered. It is kind of along those lines. I don’t know if my lender was being maybe more conservative, but for that we purchased the multifamily that had leases in place already, you know, and we were trying to get into the property and and I asked that specific questions. We have leases, the rents are already established and we’re going to inherit those leases. So this is our income. Can you use that as part of the income band? And it was like as if they didn’t want to use it again. Maybe they would try to keep it simple and not go down that route of, you know, getting in. Do you see that? Yeah.

David Boye: [00:35:08] So the question being asked us to get it into the mike is a person here watching this presentation was trying to get multi-unit property and they were not being given credit for the current leases. So the basically, there’s two kinds of lending in the world right now that just to keep it super simple. There’s traditional and then there’s nontraditional. So there is nontraditional lending happening right now. So when you walk into the bank. Most banks are not doing nontraditional lending. So what is nontraditional lending, if you need it? Well, basically there are lenders out there who are offering loans based on the income potential. As long as you’ve got skin in the game and their that’s their entire business and they’re not banks, they’re basically what you call like a hedge fund. A bunch of rich guys have gotten together and they say there’s a big opportunity in the market. It’s people that want to do things that don’t have either tax return income or rental income experience. And in their mind, if you got the down payment, you’ve addressed their risk situation. And as long as those rents are there now, what’s the why isn’t everybody doing that? Ok, well, there’s an upside in the downside. The upside is you can get the loan. The downside is they’re running about one and a half percent higher on the interest rates.

David Boye: [00:36:30] Ok, so why not? I mean, they’re offering a product and nobody else is offering. So if the interest rate on an average mortgage is three or something percent and you go get one of these products, it’s going to be like four and a half or somewhere in there. You just do the cash flow math focus on that because if you’re in acquisition mode and you end up getting all this stuff, the beauty is, is you can you can make adjustments down the road. So statistic that I know because I own a mortgage company is the average mortgage never survives longer than five years. Well, what happens? Well, there are circumstances change and they get a new mortgage. So that mortgage you’re staring at to acquire the property is exactly that. But. The average homeowner, even if they just buy one house and they cycle it through an entire 30 year lifespan, the average homeowner is going to go through like four or five mortgages in that. Well, why does that happen? Well, they buy the house. The house goes up in value. Maybe they take some of the equity and do another loan or they buy a house and they they got to put their kids through college and they just had to use the house.

David Boye: [00:37:35] Whatever the reason is, your equity goes up. The interest rates go down. Other things happen. It makes sense to look at financing over and over again every couple of years as you get more properties, you also have the ability to consolidate. So if you have 10 properties, maybe you only need mortgages on three or four of them, so you start tightening things up and then that’s freeing you up in other areas. So getting at the if you use a product that is currently a little bit higher in the rate than the absolute best you could do if you met all the qualifications, you’re probably in that relationship for two to three years. And usually I just give my clients the math. I’m like, Hey, if you buy this four hundred thousand dollar investment property and you take a higher rate, it’s going to cost you twenty thousand or thirty thousand over the next couple of years more. Well, a lot of people looking over their shoulders the last couple of years are like, that’s a risk I’m willing to take because the market outperformed that. And so you just have to make a decision. Is it worth it to go now or is it worth it to wait? Because meeting everything that a bank wants you to do to get everything you know, banks are conservative.

David Boye: [00:38:43] As a general rule, the bank is in business to protect the depositors money. On the brokerage side, we use bank loans, but we also use like that that product we talked about. Those are people that are kind of like you, that are an investor and they’re they’re in it with you. And so that’s a way to solve the problem. So they’re absolutely tools to solve the problem. And I actually put this on the bottom, but I’ll move it up, you know, never take no for an answer in lending. The answer is when and how. And it’s never known. So if you’re getting no, you need to know why. The answer is no, and then you need to start working that start talking to people like this gentleman just did in the audience, he said. I was just at the bank and I and I was told, no, and now we’re talking, right? So don’t take no for an answer. In real estate, there’s a lot of successful real estate people that when you look at their life span of work, you see them running to know all the time. But they finally yes. Or they they go, What’s the playbook? Give me the tools, you know?

Curtis Wagner: [00:39:43] Well, I’ll back that. I mean, I’ve seen countless times on on people that have come up to me and said I really wanted to buy a house, but I went to go talk to the bank or I went to a lender and I got told no for such and such reason. And I said, You know, let me let me be free off to someone that I know that is willing to take on your special situation scenario had luck with them in the past. And sure enough, you know, within a couple of weeks, they’re approved. And then within another couple of weeks, they’re under contract with the house and they couldn’t be more ecstatic. And and thank me for, you know, it’s not me that did. It was the lender that helped them out, but at least I was able to give them that opportunity of not shutting down their dreams. So it is definitely, you know, you can go to different lenders. They have different programs.

David Boye: [00:40:32] Well, Curtis, if if you’re not prepared to answer this one on the spot, it’s fine. But one thing I had written down that we might talk about is contract strategy. Do you have any advice for people on, especially in this market? It’s kind of like you go out there, and if there is that one thing that everybody’s going to want, you know, maybe everybody wants it right? So so we’re coming into this idea and we’re going to buy multiple properties and we’ve been to the mortgage lender and we’re approved by something and we come to Curtis office. And what’s our strategy like? How do we how do we win the contract war? Well, right

Curtis Wagner: [00:41:08] Now, the times of being super creative on, you know, a contract is is ever present. There are many different ways to structure a contract. And one of the biggest things that I do is, you know, find out first, what is your ultimate goal? You know, what are what are your what are your restrictions, what your income restrictions, what your, you know, how much are you putting down those type of questions that I asked to get that information? And then, you know, the first thing I do is actually call the other agent and I ask them, what’s important to your seller? You know, is it a longer close, a shorter close? You know, what are they? What’s their concerns on earnest money? They do. They feel like they they wanted more security. You need to put more down on that and different things that are important, you know, hey, they don’t want they don’t want a lot of risk and so they may not want all these contingencies. So then we go back to the drawing table and, you know, we write up. I always recommend a home inspection. I always, always recommend it. There have been some scenarios where, hey, you know, we probably are. And in at the same price point as eight other people, you don’t have the ability to go above and beyond. So what are some things in this contract that we can make more attractive? And so knowing and understanding the risk of not which I always explain to them of not getting it into home inspection, there could always be something that you don’t know. It looks good on the outside, looks good when you walk through it. But what’s under that rug? You know what’s going on with the the HVAC in the water heater? What about the roof? So there are risks to that.

David Boye: [00:42:44] But but there’s a there’s a negotiating opportunity once you get the inspection right because you’re under contract, you’ve got a price. So now you won the contract. But now that you know the condition of the home, there’s opportunity there, right?

Curtis Wagner: [00:42:58] There is opportunity. You know, if you have an opportunity to go back to the seller and have them address and fix some of these major concerns for you, which I always say should be structural and safety concerns, those are the biggest things that every home, even new construction, is going to have a list of small things that maybe isn’t up to code or that an inspector. They’re doing their job. They’re going to find it. But you can go back and negotiate with that seller to say, Hey, in lieu of you not fixing these, we’re going to ask for a lower purchase price or, hey, we want you guys to fix all these things so we don’t have the burden on us once it’s ours and we’re where the owners of it.

David Boye: [00:43:35] And I’m not 100 percent sure I understand this, but maybe you can clear in Montana, once you know facts about a property, you have to disclose those facts, right? You do. So obviously, not everybody is hundred percent ethical. But if you get that information presented to the seller, the seller is faced with the reality at that point that they’re no longer in the able to market that property without being like it needs a new HVAC system because now everybody knows, right? Right.

Curtis Wagner: [00:44:03] The technical term is adverse material effect. They now know if it fell out of contract and the buyer or seller walked away and said, Hey, I’m not willing to fix these things. And because the seller says I’m not willing to fix these things. Buyer says, OK, we’re not. We’re not going to purchase a home. We get our earnest money back. We’re going to move on to the next one. Now, as a seller and as a as a seller’s agent, you are required because you now got a copy of that report because they get to see what’s on the report of the things that get called out and they have a copy of the inspection notice of the things they wanted that is now known to the seller. Now they know that, you know their dishwasher has a problem or has a leak. Now they know that the roof is at the end of its lifespan. So when they go to market again and they get a call from a buyer’s agent and they say, Hey, what happened? You know, there are certain restrictions. We can’t talk about every contract, but they then have to disclose it fell out due to inspection. Then there’s an owner’s property disclosure. They now need to update their owner’s property disclosure, which list all known adverse material effects on the house, all known things that a buyer would want to know before purchasing the house ethically.

David Boye: [00:45:12] So it sounds like it may not be comfortable for everybody to have fun at this stage of the game, but you can help your client get a better deal.

Curtis Wagner: [00:45:21] Absolutely, because it only hurts. It really does only hurt the seller in the long run. You know, they better take care of some of these major issues because that next buyer is going to have the same concern and the next buyer is not going to want to give you your purchase price of what you’re asking. Knowing that there’s these issues.

David Boye: [00:45:34] So I’m glad we talked about that because what we get at our mortgage office a lot right now is people sending us kind of, I guess you call it like a junk property and saying, Can you lend on this? And it’s kind of an interesting question because everybody’s looking at the property and it is what it is, right, like in the seller might not be talking about anything wrong with it right now. And I tell them, I say, Well, let’s get it under contract and then let’s see if we can make it through. And if I’m doing real estate purchase as a strategy, I’m not going to get emotionally offended if I don’t make it all the way through. But if I want to get a good deal, maybe take a shot at it because once all this stuff hits the table. If we survive that, I just got a good deal on a piece of real estate, you know, so. Great point. Any other big points on contract strategy? I got a couple other things.

Curtis Wagner: [00:46:21] I think we can move on from it.

David Boye: [00:46:23] Poole Yeah, like the financing, have a strategy, you know, don’t just willy nilly write a contract. One thing I will say that Curtis mentioned and it’s important is we just had a client in our office yesterday that we probably qualified him for a loan, a certain price. And they made this comment to me, and I think it’s an important comment to address. They said, Well, we talked to our realtor, and she said that they’re only taking cash offers. And I said, You know, you need to go back to your realtor and you need to straighten this out. I go, You’re a loan buyer. Your realtor should be happy to be working with you as a loan buyer. So when you are working with your realtor, you’re coming in. Let’s say you’re coming in approved at $500000, you’re a $500000 buyer and you need to be working with a realtor who’s calling you a $500. Not a non-cash buyer, because the reality is that if that seller thinks the deal is going to close, it’s not that big a deal to them. Whether you’re cash or loan, what what do they care about? They want you to close. And so encourage or for yourself, you know, and make sure you’re working with the team. That is totally fine with the fact that you’re getting the loan. If you’re getting a loan and then and don’t don’t look at that as an obstacle, it’s all about the presentation.

David Boye: [00:47:40] Curtis just set it straight up. He’s going to call that selling agent and he’s going to find something that they’re interested in, and that will immediately take the focus off of whether it’s cash or whatever. Because if you can deliver what they want, which is $500000, then they’re not that concerned about how they get it. They just want to get it, you know, and you have that power with a loan. Real quick fundamentals just so that we cover it. So all loans go through on the three CS. So I usually talk about this in every class, but no loans go through without them. So what are the three C’s? Every loan is based on the cash flow of the borrower. So however we come up with that cash flow could be the rent could be their income. But cash flow is a piece of the equation. The other the second C would be the collateral. So is this property worth what we’re paying or does there need to be some amount of money to compensate, but that will be evaluated on every loan transaction? And then finally, the credit so you need to pay our bills. So if you don’t pay your bills, you’ll have a harder time getting a mortgage, you know, so those three C’s every time.

David Boye: [00:48:52] So whenever people call me in a panic and they say my loan is not going through without referring to the three C’s and we’re interviewing and we’re finding out if there’s a problem with the Three C’s, because if there is, that may be an insurmountable problem or it’s something we can fix. But you either need to fix one of the three C’s we already talked about never taking no for an answer. So I encourage everybody to get their dream scenario on the table with somebody who knows what they’re doing and find out where if they’re deficient in an area started addressing the deficiency, but don’t take no for an answer. So if you want to own 10 homes, you know, $6 million and have a lot of rentals and things, and currently you don’t have anything that is an achievable dream, you need a roadmap, it start working on it. It could be starting with this plan that we laid out by your first couple of primary residences, convert a couple of rentals and start like you don’t need $1.2 million to acquire $1.2 million of real estate in this class. You’ve presented a playbook where you can do it with $50000 and a job. So it’s important to know that.

Curtis Wagner: [00:50:03] Absolutely. The last time last thing I want to say is you kind of touched on it already, which I loved it was and I had it written down right here. Real estate transactions, it’s a business transaction. It’s a business deal. It’s not an emotional deal. Now, it is emotional, right? But it’s a business transaction. And so just like you said, if you know it’s not working out with one one house, you know, let it go and move on to the next. As a seller, you get very attached to your home. And so you add a lot of value personally, you have the memories in there. But if you’re going to go sell a personal home, realize it’s a business transaction is what it is, so you can keep those emotions out of it. And I’ll just end with one story is, you know, there’s a story of a buyer that was really picky buyer and they went through multiple multiple homes and just picked them apart, you know, even when it was an open house and the listing agents, they’re the sellers even probably present and they just come in, Oh my gosh, what about this color? I can’t believe someone to pick it and just just nitpicked all the homes. Finally, after months of looking found what she said was her dream home, but she was a basket case and she was emotional and she at the 10th hour right before they had an opportunity to back out. So they’re at the end of their contingencies. And it was now or never.

Curtis Wagner: [00:51:25] If he wanted to back out, you better do it tonight or not, and she decided she got to. She texted her agent and said, I want out. So they just said, Are you sure? Is this really what you would? Don’t you want to sleep on it? No, this is. This is what I want. Ok. So she sent the termination paper over to the agent, and they had a backup offer in place backup offer, meaning there a second buyer that that contract got accepted and the first offer fell through. Second buyer should be in position early the next morning, about 5:30 in the morning, the agent looks at her phone. It’s a text message from her buyer. Is it too late to still get the house? Oh. So she was emotional she finally slept on it and she thought, Oh my gosh, I made a mistake well, ended up where the agent was able to call the other agent, and that agent said I sent the backup offer that they’re going to be in primary position. I sent it over to them, but they have not gotten back to me yet. So I think you’re in luck and they were able to close on the home, but I just take that because it does get emotional. But on my side, as a real estate agent, it’s I see the business side and it really, really helps yourself on both selling and buying. If you can leave the emotions out of it and look like look at it as a business transaction

David Boye: [00:52:39] That are on our wall at Black Diamond Mortgage, we have a poster. It’s called Stay in the Boat and it’s got three scenes and it shows people going through a mortgage transaction. And the third scene is everybody jumping out of the boat because they’re all freaking out. And then they have to get back in the boat and start with a new closing date because everybody freaked out. So stay in the boat. And yeah, like on that termination letter, you know, like, don’t sign something right away. Take your time. You know, be a professional. Do we have any other questions from the audience? We’re pretty much right at the point we wanted to be out to wrap this thing up. Go ahead. Early on, you talked about you staying in houses for two years to get the tax benefit. But then throughout the process you’re talking about, you’re saying you can stay in for one year. If you do that, you lose your tax benefit if you want to sell three years later or whatever. Correct. So you know a little disclaimer check with your accountant on all tax advice. I’m not an accountant, but the deal is, is the tax on your primary residence after you’ve had two years in it, you get this huge write off that’s allowed without paying the tax. And so most people, the other strategy that’s not the one we talked about today is the one that Curtis did. It goes back years in the United States as you buy a house and at the at the two year anniversary, you sell the house, carry the money over to the next house and you don’t have to pay tax on that profit.

David Boye: [00:54:02] And that’s a good strategy if you’re going to carry the down payment money from the prior house because you don’t want to pay tax on it. So tax avoidance is a completely different strategy. So as a general rule, tax avoidance is a two year strategy per home. But if you’re not selling the home, then this is not a problem because you’re only going to pay the tax when you get the the sale or the capital gain. So the easy answer is is if you’re doing multiple properties and you want to do tax avoidance, you’re not selling right away and down the line, you might roll these properties into what they call 10 30 ones. If you want to make transfers, you can keep it tax free for a long time. So two separate strategies make sure you have them separate. One is real estate accumulation with limited down payment. The other is tax saving. You can do both, but they are different that cover it for you. Yeah, it sure does. All right. Well, no further questions. The material is going to be available if you didn’t get us your email address. We’re going to email it out. So make sure we have your email address and thanks for joining us. We’ll have another one next month. Thank you. It’s good. Yeah.